Get This Report about Real Estate Reno Nv

Table of ContentsGetting The Real Estate Reno Nv To WorkThe 9-Minute Rule for Real Estate Reno NvThe Of Real Estate Reno NvExcitement About Real Estate Reno Nv

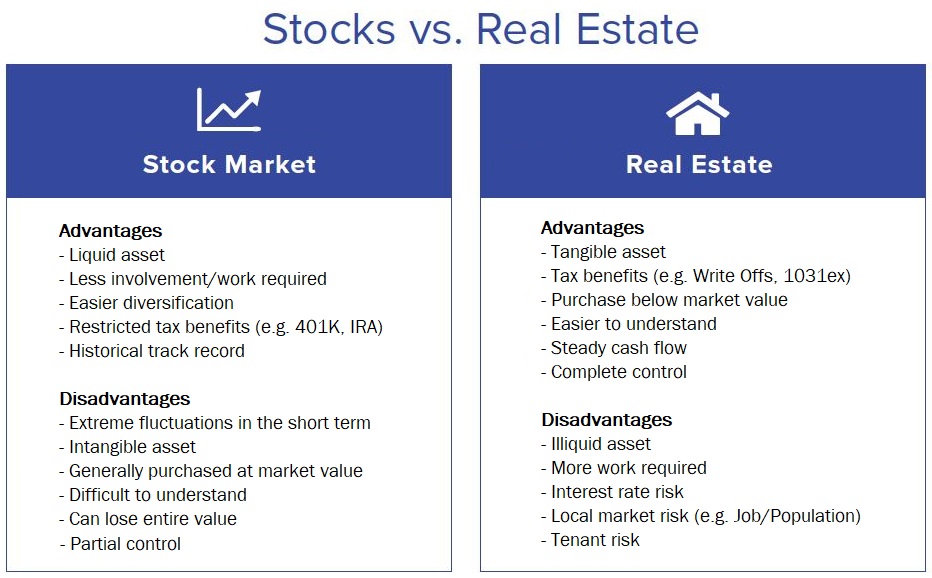

That might appear pricey in a world where ETFs and mutual funds might bill as low as zero percent for constructing a diversified portfolio of stocks or bonds. While platforms may vet their financial investments, you'll have to do the same, and that means you'll require the skills to analyze the opportunity.Like all investments, actual estate has its pros and cons. Long-term recognition while you live in the residential or commercial property Potential hedge against inflation Leveraged returns on your financial investment Passive earnings from leas or with REITs Tax advantages, including interest deductions, tax-free capital gains and devaluation write-offs Fixed long-term funding readily available Admiration is not ensured, specifically in economically clinically depressed areas Residential property prices might drop with greater rate of interest prices A leveraged investment suggests your down payment is at risk Might require significant time and money to manage your very own residential properties Owe a set mortgage payment every month, even if your renter doesn't pay you Reduced liquidity for actual residential or commercial property, and high payments While genuine estate does offer several advantages, particularly tax obligation advantages, it doesn't come without considerable drawbacks, in certain, high commissions to leave the market.

Or would certainly you choose to assess offers or financial investments such as REITs or those on an on-line system? Expertise and abilities While several financiers can discover on the job, do you have unique skills that make you better-suited to one type of financial investment than an additional? The tax benefits on real estate vary extensively, depending on just how you invest, yet spending in genuine estate can use some large tax obligation advantages.

Real Estate Reno Nv Can Be Fun For Anyone

REITs offer an appealing tax profile you will not incur any type of resources obtains tax obligations until you sell shares, and you can hold shares essentially for years to prevent the tax man. Actually, you can pass the shares on to your successors and they will not owe any kind of taxes on your gains.

Actual estate can be an appealing investment, yet financiers desire to make sure to match their type of investment with their determination and capability to manage it, including time dedications. If you're seeking to generate revenue throughout retired life, actual estate investing can be one means to do that.

There are numerous benefits to purchasing property. Consistent earnings circulation, strong returns, tax benefits, diversity with appropriate possessions, and the capacity to take advantage of wide range with real estate are all benefits that capitalists might delight in. Below, we explore the various benefits of purchasing realty in India.

Rumored Buzz on Real Estate Reno Nv

Property often tends to value in value over time, so if you make a wise financial investment, you can profit when it comes time to market. With time, leas likewise tend to raise, which could boost capital. Rental fees raise when economies broaden since there is even more need for genuine estate, which elevates capital worths.

If you are still functioning, you might maximise your rental revenue by spending it following your economic objectives. There are various tax benefits to genuine estate investing.

It will substantially decrease taxable earnings while reducing the price of actual estate investing. Tax obligation deductions are offered for a variety of expenses, such as firm costs, cash money circulation from various other assets, and mortgage rate of interest.

Real estate's web link to the other primary property teams is breakable, sometimes even adverse. Actual estate may consequently lower volatility and increase return on threat when it is consisted of in a profile of numerous possessions. Contrasted to various visit this page other assets like the stock market, gold, cryptocurrencies, and banks, spending in property can be substantially more secure.

Little Known Questions About Real Estate Reno Nv.

The stock exchange is continuously altering. The actual estate industry has actually expanded over the previous numerous years as an outcome of the execution of RERA, reduced home loan passion rates, and other factors. Real Estate Reno NV. The rates of interest on financial institution cost savings accounts, on the other hand, are low, especially when contrasted to the increasing inflation